Imagine No Stock Market Losses and Tax-Free Income for Life

Imagine Getting Rid of Stock Market Losses and Still Earning A Reasonable Rate of Return

Imagine no longer suffering yo-yo volatility and gut wrenching stock market losses while earning tax-free income. This short video shows you exactly how to accomplish this and still earn a reasonable rate of return on your money. There’s more…

Would you be OK earning 6% to 9% tax-free on your money with no downside risk? It’s possible with The Perfect Retirement Solution. A Tax-Free Retirement Alternative Plan, also known as Living Benefit Life Insurance or Tax-Free IUL. Historically, these plans have averaged over 8%.

What’s the trade off? In exchange for no downside risk, annual upside is capped, currently 13% to 16%, depending on the index chosen and the Insurance Carrier. This means you earn up to the cap rate in any given year. Gains are locked in annually, so you never give back profits already earned.

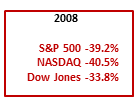

During the market melt down of 2008, the S&P 500 and Nasdaq Indexes were down about 40%, but none of our clients lost money due to market volatility. Zero was their hero. Their money was safe and secure, and their income steady and reliable.

Properly structured Living Benefit Tax-Free IULs are approved by the IRS and this strategy has been used by America’s wealthiest families to cut taxes and preserve capital for more than 20 years. It works.

New quick read eBook Explains How It Works

Free download and more videos https://www.bruceecoxcpa.com/

• So, if you hate paying taxes and hate even more losing money in the stock market, pay close attention.

• If you are worried you won’t have enough money to enjoy your retirement, this strategy will help you generate a tax-free income you won’t outlive.

• If you want to implement a gifting strategy for your children or grandchildren, the tax- free IUL is a vehicle that can keep on giving with a lifetime of tax-free income.

• If you like the idea of having a tax-free emergency fund to tap as needed, the tax-free retirement plan is for you.

• If you would like to be your own bank, funding big ticket items with retirement funds, paying interest to yourself rather than a bank, this could work for you.

Fortunately, the quick and easy to implement tax-free retirement alternative solution addresses all of the above.