Retirement Taxes combined with Market Losses Could Crush Your Retirement Dreams

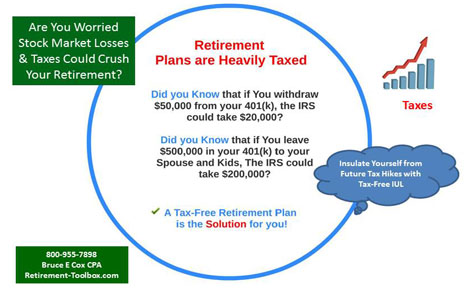

Are You Worried Stock Market Losses and Taxes Could Crush Your Retirement Accounts?

Retirement Strategies: The tax-free pension alternative is living benefit life insurance or the tax-free IUL.

Retirement Taxes could crush your retirement dreams. Did you know that if you withdraw $50,000 from you 401(k), the IRS could take $20,000? Did you know if you leave $500,000 in your 401(k) to your spouse or kids, the IRS could take $200,000?

Heavy taxes can exhaust even gut your qualified retirement plans, your IRA, 401(k) or 403(b), quickly. This is a major reason many people run out of money 7 to 10 years into a 30 year retirement.

There is a little known IRS strategy that the wealthiest top 10% of American Families, including the top 1% have been using for more than 20 years to cut taxes and preserve capital. The Strategy works. It has been called the Perfect Retirement Solution.

• You don’t lose money when the markets go down!

• Share in Market Upside when Markets go up!

• Earn Reasonable Rates of Return!

• Gains Locked In Annually!

• Tax-Free Penalty Free Withdrawals at any age!

• Tax-Free Income You Won’t Outlive!