Longevity Risk! Will You Have Enough Money to Enjoy Your Retirement?

Longevity risk. If you retire in your 60s or 70s, your money has to last you 30 years or more. Many people run out of money 7 to 10 years into retirement.

- Withdraw too much money in the early years of retirement

- Heavy taxation of retirement plans were not considered

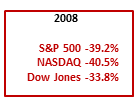

- Risky investments caused big stock market losses.

- Did not save enough

Tax-Free Solution

There is a little known IRS approved strategy that the wealthiest top 10% of American Families, including the top 1% have been using for more than 20 years to cut taxes and preserve capital. The Strategy works. The Tax-Free IUL can produce a Tax-Free Income You Won’t Outlive! The strategy has also been known to double, even triple after tax income compared to a 401(k) or 403(b) retirement plan. It has been called the Tax-Free Pension Alternative.

If you can double even triple your after-tax income, your money will last longer. Going with a tax-free retirement plan also insulates you from future tax hikes. A Zero taxed tax-free plan is better than a heavily taxed qualified plan, such as an IRA, 401(k) or 403(b) retirement plan.

I failed to mention, the Tax-Free IUL has no down side risk. You don’t lose money when the markets go down. Annual gains are locked in, so you never give back interest previously earned. You share in market upside, up to an annual cap rate. Current caps are 13% to 16% depending on the index you choose.

Your withdrawals are tax-free penalty free at any age for any reason. Withdrawals from your qualified plans are heavily taxed and subject to early withdrawal penalties of 10% if you are under age 59 1/2.

You can request a free retirement plan comparison.